I get asked a couple times every week by journalists or people working in higher education about the financial health of a particular institution. Interestingly enough, about half of the requests in the last year have been about America’s wealthiest universities and the other half are about colleges teetering on the brink of closure. In a K-shaped economy, that seems appropriate.

Endowment spending concerns are present at both ends of the wealth distribution, with the wealthiest institutions facing pressures to spend more to avoid large cuts driven by changes from Washington and the least wealthy institutions using their small endowments as a way to keep their doors open. The generally accepted principle is that colleges should spend between four and five percent out of their endowments each year to fund operations and scholarships; this honors donors’ intent while still allowing the endowment to grow. Spending rates could likely go up to six or even seven percent for a while and match long-term stock market returns, but that becomes risky in the event of a recession. It could take a decade or more to regain value if the stock market plummets, and small colleges do not have the luxury of time.

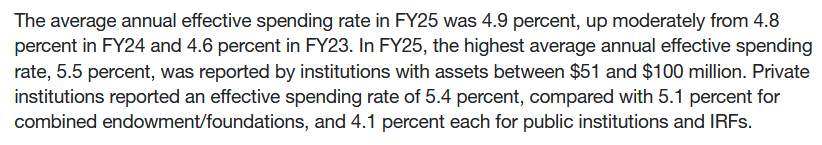

The most up-to-date source on endowment spending across higher education comes from the NACUBO-Commonfund Endowment Study. This source includes most large universities and a portion of smaller colleges, with Fiscal Year 2025 data being released last year. This paragraph from NACUBO’s press release caught my attention, as it shows increasing spending rates over the last few years and higher spending rates for the smallest private colleges.

This led me to dig into the endowment spending rates for private colleges using institution-level data from IPEDS. IPEDS added information on spending rates several years ago in response to requests from the field, which is a good example of how technical review panels used to work before the National Center for Education Statistics was nearly demolished by DOGE. IPEDS data are only available through Fiscal Year 2024, but it still provides useful insights into spending rates.

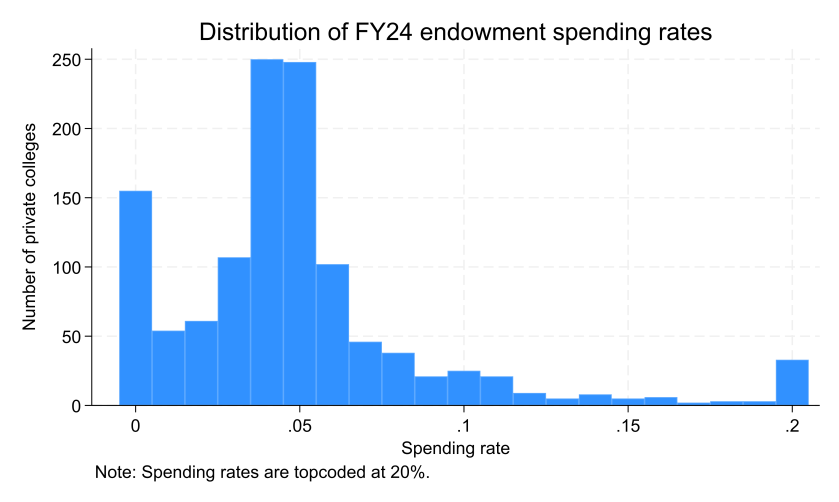

The figure below shows the distribution of FY24 endowment spending rates for 1,202 private nonprofit institutions with at least $1 million in their endowment at the end of that fiscal year. Forty percent of colleges spent between four and six percent of the beginning of the year endowment value, which is in line with general guidelines. However, eight percent of colleges spent more than ten percent and thirteen percent—disproportionately tiny institutions with endowments of less than $5 million—spent nothing at all.

To give an example of why endowment spending is a concern, look at Webster University in Missouri. In an interview with the Chronicle, I called their Fiscal Year 2023 results “a calamity,” which says something because I get asked about a lot of struggling colleges. But most colleges of that size do not manage to post a $40 million operating loss that shrinks the size of the endowment by more than one-third in just one year according to IRS Form 990 filings. IPEDS data showed a 39% spending rate in FY23 followed by a 32% spending rate in FY24. They still had about $66 million in their endowment at the end of FY24, but that is greatly diminished.

Overall, 43 colleges spent more than ten percent of their endowment value in both FY23 and FY24, which is certainly a warning sign. As usual, I compiled the data for this piece into a downloadable spreadsheet so you can look up spending rates for individual private colleges.