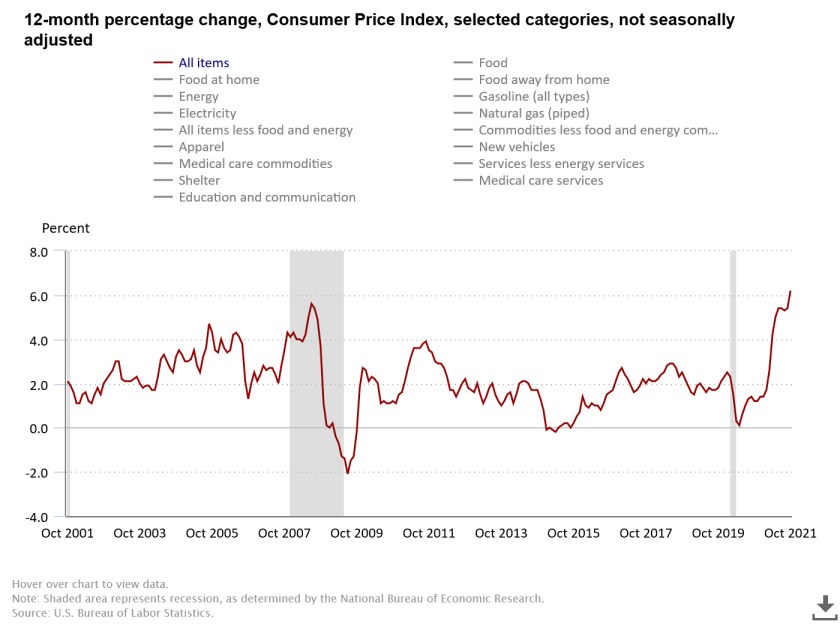

For the first time in the lifetimes of many Americans, inflation has become a legitimate concern. In the last year, the Consumer Price Index increased at a 6.2 percent clip—a rate not seen this century.

The higher education industry is far from immune from the effects of an inflationary cycle that was largely unexpected even a few months ago. Colleges have been struggling to address supply chain issues and a shortage of staff members willing to work in person at pre-pandemic wage rates. Colleges have responded by reducing services, increasing wages in some cases, and even trying to get faculty members to work in dining halls. In my position as a faculty member and department head, I am still waiting for my permanent laptop computer setup to arrive and have seen the challenges in trying to hire employees within existing salary bands.

But what really caught my attention was Virginia Tech’s move to increase meal plan charges by about $200 between the fall and spring semesters. Midyear adjustments in student charges are highly unusual and typically only happen if a state withholds previously promised funding during a recession. But the university is required by state law to have auxiliary enterprises operate with balanced budgets, so the sudden increase in costs had to be passed on to students.

At this point, it seems like inflationary pressures are here to stay for at least the next several months. This will put continued pressure on colleges to increase their salaries to keep up with a hot economy and rising consumer prices. While faculty tend to have less power in the labor market due to lots of qualified people looking to teach in many disciplines, many staff members are in a great position to command raises of between five and ten percent as colleges look to retain talent.

This is also the time of year during which many colleges start to develop their proposed rates for tuition, fees, and room and board for the next (2022-23) academic year. With the costs of running a college likely to rise by at least five percent this year, the logical step for colleges would be to raise student charges by the same amount. This would be a rate largely unseen since the Great Recession—when student debt was less of a public policy concern and there was less vocal skepticism of higher education. But if colleges try to keep tuition increases more modest, they are losing money. And that is a challenge after the pandemic severely affected the finances of many institutions.

So expect a fair amount of sticker shock this spring when tuition, housing, and dining charges for next year get posted. There are likely to be three types of exceptions to this trend:

- Public colleges in states that limit tuition increases by state law or governing board policy. They’re stuck with what they can get.

- Extremely wealthy colleges that can afford to limit increases if that will help them increase diversity and/or move up in the rankings.

- Cash-strapped colleges that are desperately seeking to recruit and retain students. They will decide that holding the line on student charges is the best of a lousy set of options.